Service Details

This data and consulting service is specifically designed for Asia battery and auto makers which seek for compliance for new EU and US regulations.

New EU Batteries Regulation: introducing enhanced sustainability, recycling and safety requirements

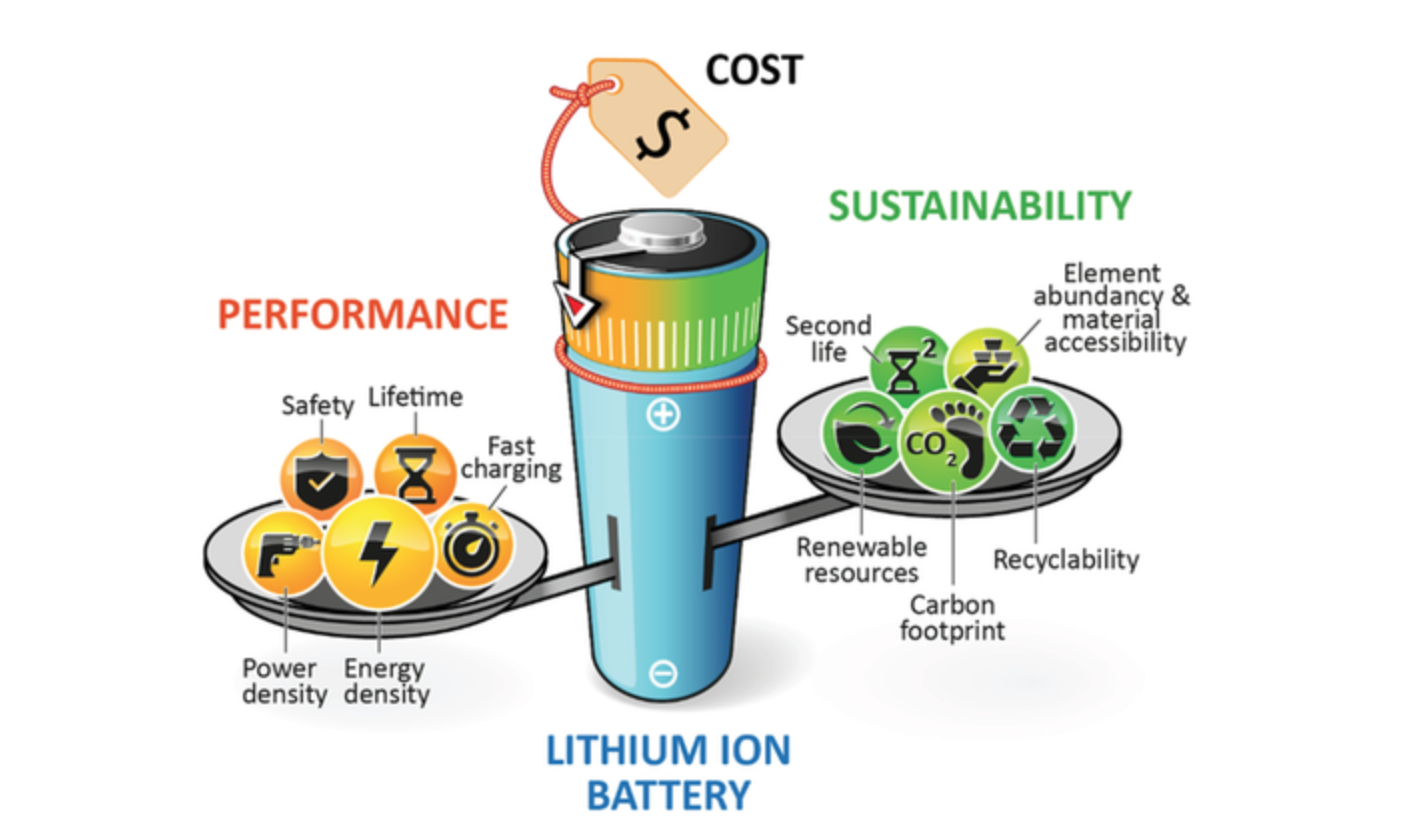

The new rules extend producer responsibility and require due diligence of supply chains to assess social and environmental risks, with a key focus on the supply of cobalt, natural graphite, lithium and nickel.

New labelling will provide consumers with more accurate information on the social and environmental impact of batteries. The new rules will apply to all manufacturers, producers, importers and distributors of every type of battery which are placed within the EU market

Batteries play an essential role in today's tertiary economy and are integral to the European Commission's plans to deliver on the EU Green Deal, the Circular Economy Action Plan and the New Industrial Strategy. The new regulation has three aims: (i) reduce the environmental and social impacts throughout all stages of the battery life cycle; (ii) promote a circular economy; and (iii) strengthen the functioning of the internal market.

The new Batteries Regulation, which comes into force on 17 August 2023: Applying to all manufacturers, producers, importers and distributors of every type of battery placed within the EU market.

The Regulation introduces changes in four key areas:

-

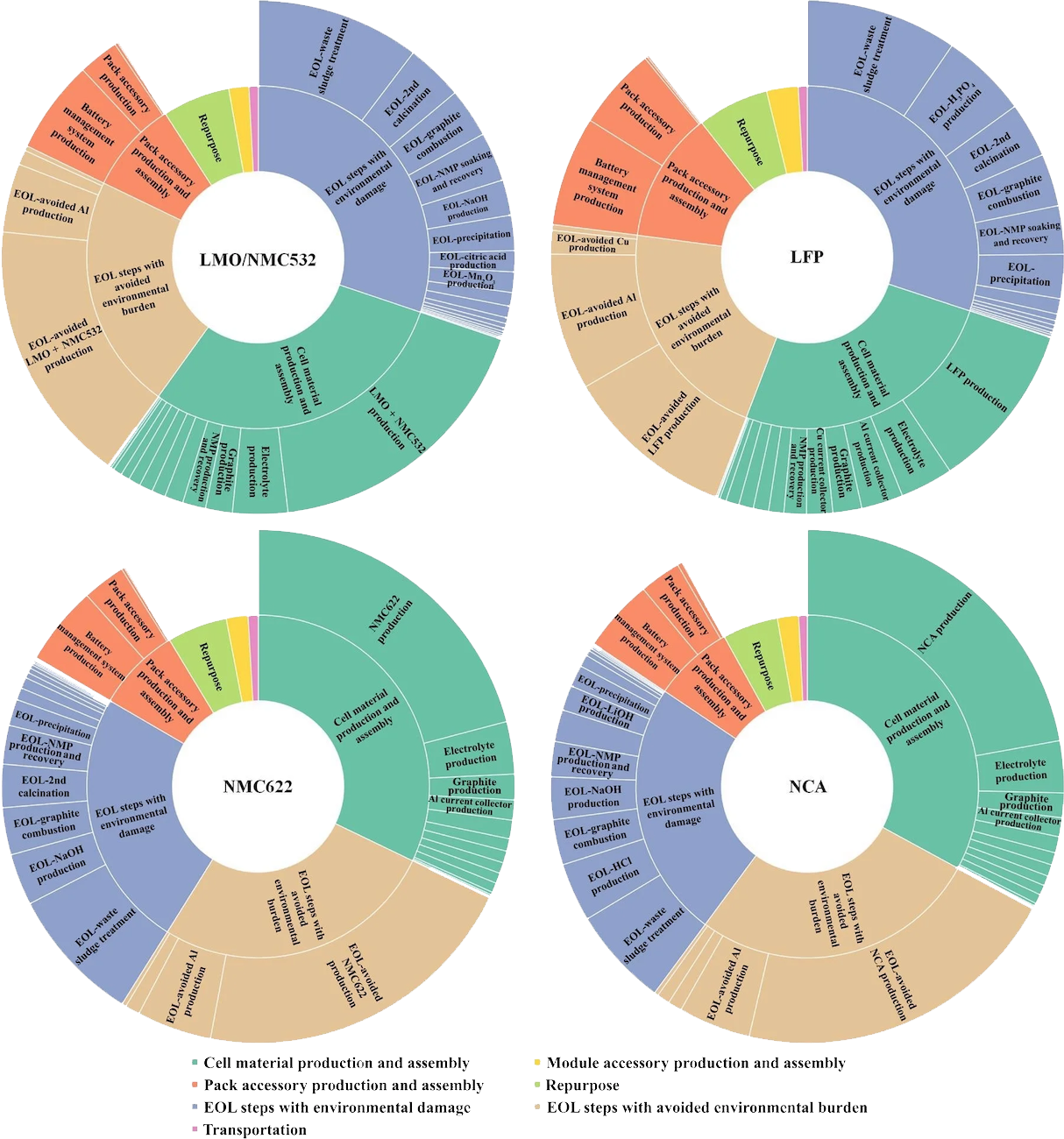

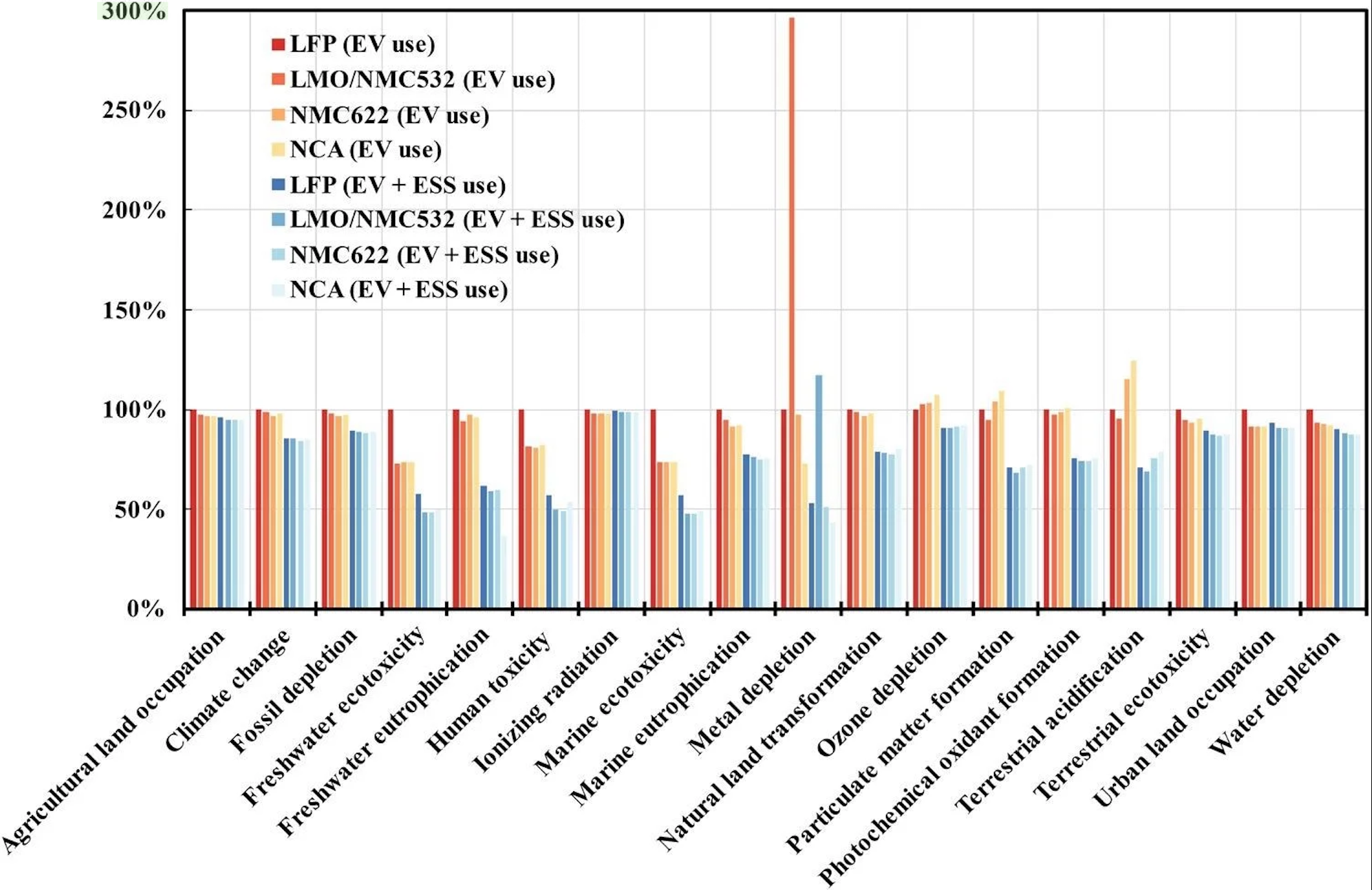

Sustainability and Safety: Carbon Footprint and Restrictions on Hazardous Substances

All EV batteries, LMT batteries and rechargeable industrial batteries with a capacity of more than two kWh must have a "clearly legible and indelible" carbon footprint declaration and label, indicating amongst others, the levels of recycled cobalt, lead, lithium and nickel used in the battery production. By 31 December 2030, the Commission shall assess the feasibility of extending the carbon footprint declaration requirement to portable batteries, and the requirement for a maximum life cycle carbon footprint threshold to rechargeable industrial batteries with a capacity of two kWh or less. In addition, the Regulation restricts the use of mercury, cadmium and lead. -

Supply Chain Management: Due Diligence Requirements:

All Economic Operators, aside from SMEs, selling batteries within the EU market must develop and implement a due diligence policy compliant with international standards to address the social and environmental risks inherent in sourcing, processing and trading the raw materials and secondary materials necessary for battery production. Specifically, Economic Operators must adopt and clearly communicate to suppliers and the public due diligence policies concerning the supply of cobalt, natural graphite, lithium, nickel and other chemical compounds based on the raw materials listed, in accordance with recognised international standards, such as the OECD Due Diligence Guidelines and the UN Guiding Principles on Business and Human Rights. -

Labelling and Information

Digital battery passport: EV batteries, LMT batteries and rechargeable industrial batteries more than two kWh will need a "digital battery passport", with information on the battery model, the specific battery and its use. More generally, all batteries must have labels and QR codes detailing their capacity, performance, durability and chemical composition, as well as show the "separate collection" symbol.

Labelling changes: All batteries will need to be "CE" marked to demonstrate conformity with health, safety and environmental protection standards applicable in the EU. The labelling for batteries included in a device should be affixed directly on the device in a clearly visible and legible manner. This marks a change from the current practice, in the EU and Germany for instance, where labelling is applied to the battery itself, rather than the overall device. The labelling and information requirements will apply by 2026 -

Recycling – End of Life Management:

The Regulation aims to ensure that batteries are subject to separate, high-quality recycling. For instance, a late change by the Council provides that the battery management system of EV batteries shall include a software reset function, in case economic operators carrying out preparation for the re-use, repurposing or re-manufacturing of EV batteries need to upload different battery management system software. This may cause certain risks, for instance, for reasons of cybersecurity. Accordingly, the Regulation provides that if the software reset function is used, the original battery manufacturer shall not be held liable for any breach of the safety or functionality of the battery that could be attributed to battery management system software uploaded after that battery was placed on the market.

The Regulation also require:

-

Maintains the total prohibition on landfilling waste batteries. All waste batteries – including LMT, EV, SLI and industrial batteries – must be collected by Economic Operators free of charge for end-users, regardless of the nature, chemical composition, condition, brand or origin of the waste battery in question.

-

Sets out compulsory minimum levels of recycled content for reuse in new industrial, SLI and EV batteries: six per cent for lithium and nickel, 16 per cent for cobalt and 85 per cent for lead. Every battery will be required to specify the amount of recycled content it contains.

By 31 December 2030, the Commission will assess whether to phase out the use of non-rechargeable portable batteries of general use.